How Finalyse can help

Designed to meet Prophet modelling requirements of the Actuarial and Risk teams

Combining a technological and practical approach to deliver actuarial and risk modelling solutions

Helping you comply with the Solvency II regulations as well as optimising your Solvency II balance sheet

Written by Divyank Garg, Senior Consultant, with support of Francis Furey, Principal Consultant.

Introduction

Finalyse risk advisory for insurance offers a comprehensive range of actuarial and risk management services to provide solutions tailored to unique challenges faced by insurers.

As an independent consultancy, Finalyse is agnostic in terms of modelling tools, and our aim is to support firms identify the best tool based on their requirements.

This blog post is intended to highlight the key features of one of the modelling tools, Insurance risk suite (formerly, Prophet), a proprietary tool offered by FIS[1], to help insurers understand the importance of the skillset required to apply on such modelling tools.

Overview

Many insurance firms use proprietary modelling software to perform actuarial modelling. The speed and flexibility offered by FIS ® Prophet[2] makes it a popular choice.

In this blog post, we aim to provide a high-level overview about the key and advanced features and applications of Prophet along with their practical user experience and challenges.

Furthermore, we discuss how the need to merge models has arisen over time as a result of new regulations and standards. We also discuss the key considerations when migrating to Prophet including reviewing and validating actuarial models and importantly, model governance considerations for Prophet models.

Key Features

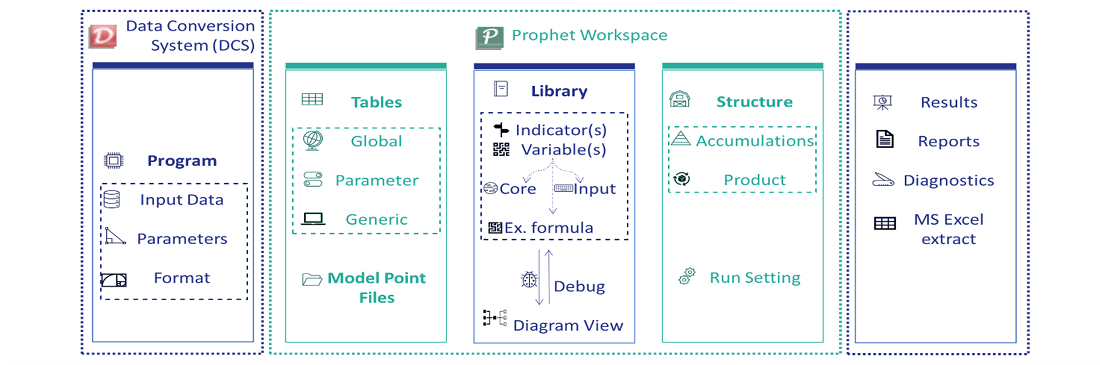

Some of the features and applications offered with the Prophet workspace are highlighted on the chart below and we discuss the most popular ones amongst developers and users in more details subsequently:

Data Conversion System (DCS)

Data Conversion System (DCS) is an application widely used by Prophet developers that helps structure the raw data and produce model point (or data input) files in a format acceptable for Prophet.

It allows reference tables along with multiple input data files to be used to adjust and enrich data. The program is capable of producing single or multiple model point files for each product or product class and can be configured to output either individual policy level model point files for Prophet calculation runs or grouped policy model point files for Prophet grouping runs.

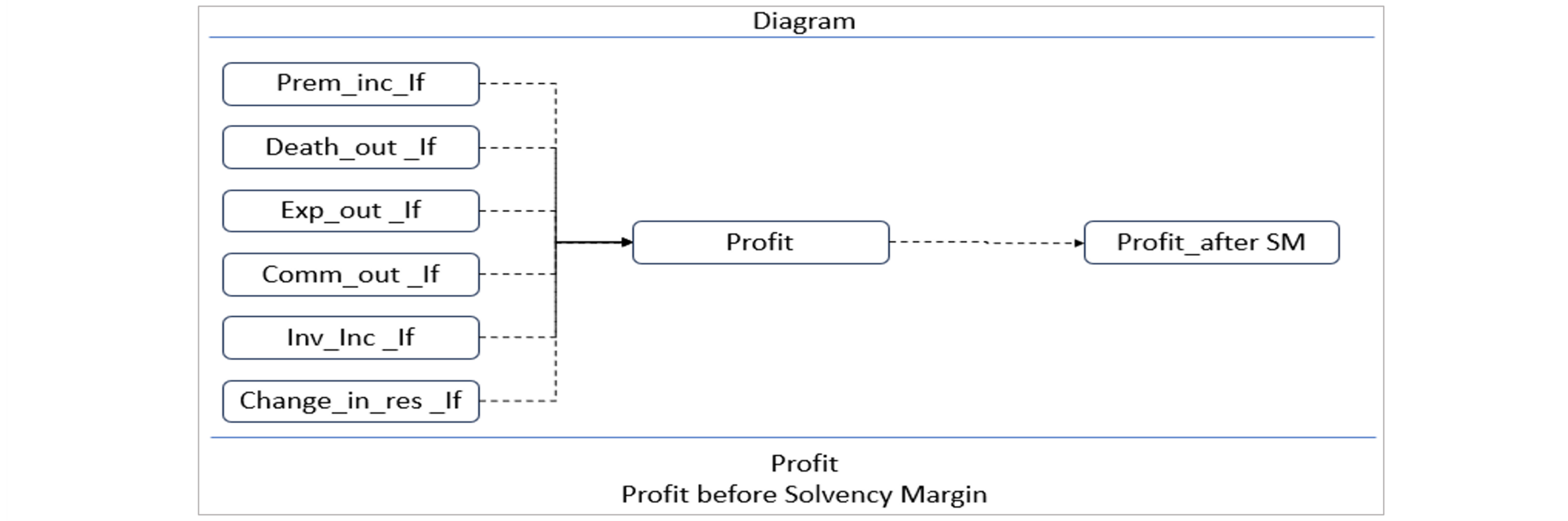

Diagram View

Diagram View is an important feature for a Prophet model developer as it makes it convenient to trace dependents and precedents of variable(s) in each library. It provides transparency that helps with debugging, troubleshooting and to gain deeper understanding of cashflow components and results. The diagram view also shows resulting values of variables when a completely executed run is selected for a product or an accumulation[3].

Model point files, tables, modules, and variable properties can be inspected through the diagram view in the variable flow as shown on the chart below:

Filters can be applied in the diagram view as desired and convenient for modelling. For example, filter by dependent or precedent, filter elements of array dimension or exclude self-referencing variables, etc.

Schedule

Schedule is a useful feature that enables Prophet developers to form a view on key aspects of products modelled in the workspace. It is used when merging multiple Prophet models which were developed for various calculations like IFRS17 and Solvency II or where a business combination exists, to optimise resources and to streamline the library structure.

This produces a grid of variables (all or specific type) and products indicating the variable type, indicator or dimension, etc.

Parallel Processing

Parallel Processing provides additional benefit to attain higher performance than a single processor-based system. This means that multiple machines are connected to a network with a Master PC assigned and used to operate from. This enables leveraging the computing power of all the PCs appropriately connected via a server which results in reduced runtime by splitting either the products, simulations (e.g., in case of stochastic calculations) or multiple model runs across different processors.

Features like multi-threading are also useful to improve efficiency which comes along with the Enterprise solution (offered by FIS).

Advanced Features

Advanced features within the Prophet allow for complex calculations in an efficient manner. Some of these are discussed below:

The Asset Liability Strategy (ALS)

The Asset Liability Strategy (ALS) library supports investment decision making. The library provides a mechanism to model assets and liabilities together including complex interactions such as policyholder behaviour (e.g., dynamic lapses) and management actions (such as discretionary dividends, bonuses, or participation rates). It makes the asset liability models more dynamic while:

- Measuring the impact of different investment strategies that include the re-balancing of asset portfolios

- Measuring the value of new business and the impact of acquired portfolios

- Calculating the risk-based capital, including Solvency II and Internal Model

- Performing stochastic calculations to appropriately estimate the time value of options and guarantees, etc.

The ALS library is considered one of the most complex libraries, as it involves extensive code specifically defined in extended formula.

Extended Formula

Extended Formula are variable types, and these are either already defined in a library (e.g., the ALS library) or can be created to enable specific and more complex calculations than those carried out by the standard Prophet formula.

Examples for use cases of extended formula include the rebasing of guaranteed rates, the isolated calculation of each group of paid-up contracts and the increments in contract benefits.

Extended formula can be set up either as time dependent or non-time dependent given the requirements. It allows additional variables to be defined within the formula when they are not defined elsewhere in the Prophet model. Parameterisation within the extended formula can be used to optimise the model performance.

However, the variables defined within the extended formula are not displayed in the diagram view with associated dependencies and the values stored in the extended formula’s internal variables are not visible directly in the model, therefore debugging gets challenging at times.

Stochastic Calculations

Stochastic calculations involving multiple simulations can be performed using Prophet. They can be tailored to optimise shareholder and policyholder investment returns by understanding the interaction between bonus rates and future investment performance, to allow for guaranteed annuity rates or to perform insolvency and stress tests to meet the requirements of various capital regimes such as embedded value or Solvency II.

Setting up a stochastic run is different to a deterministic run. For example, it requires stochastic tables where assumptions vary by simulations with appropriate configurations for the run structure and settings.

Model Merge

There have been a lot of actuarial model developments recently due to the implementation of IFRS17 from 1 January 2023 and this was preceded by another wave of developments in Europe around the implementation of Solvency II on 1 January 2016. This has created decentralised models over the period within many organisations.

Maintaining and developing multiple models give rise to inconsistency in input and output, often leading to inefficiency due to duplication of effort, longer runtime, even misinterpretation of results. Maintaining an inefficient modelling architecture can become more challenging, especially if modelling resources are constrained.

One way to address the challenges mentioned above is to consolidate or merge models in order to:

- Standardise pricing, business reporting, business planning and asset liability management processes and enable reporting on more than one basis using a single valuation model

- Avoid the complexity of model dependencies which are holding back key modelling decisions

- Easily implement model updates and include essential components that are required in models for all activities

Some of the key aspects to keep in mind while considering activities related to merging Prophet models include:

- Use of comparison logs of libraries across different models

- Use schedule to understand indicators and variable definitions while combining them

- Import variables to the base model

- Adjust indicators and create new indicators and/or variable definitions

- Perform unit tests for each product type, compare premiums, reserves, profit, profit after solvency margin, etc., for all products before and after the merge

- Perform regression tests

- Document the steps taken and develop a change log along with objectives

Additional steps might be needed depending on complexity, time constraints, resistance against change or availability of resources.

Model Migration

In an insurance company with a growing book of business and an expanding product offering, it becomes imperative to have a solution that caters for the needs of the business and to achieve consistency of cashflows enabling better decision making. Most insurers consider criteria relevant for finding a solution that best meets their needs in terms of scalability, flexibility, efficiency, cost, etc.

Insurers might choose to migrate, for example:

- From their existing solution to Prophet (or vice versa)

- To Prophet Managed Cloud Services (PMCS) that provides computing, network, and storage resources, if already using Prophet

- From asset and global libraries to the ALS library within Prophet

Migrating models may result in operational efficiency, help align models across different business units and reduce the number of manual calculations without the loss of prevalent functionalities.

Model Review and Validation

With multiple models used by firms, it has become important for insurers to have their models validated to ensure the accuracy and appropriateness of their design, data, assumptions, methodology, results, and governance. The need is exacerbated with the increased regulatory focus on processes, data quality, models, and governance.

Primary reasons for validating Prophet models include:

- To validate the output from various models, including cashflow testing and to conduct model reviews on embedded value

- To reduce the number of unexplained components of the model output in case of analysis of change

- To compare the model output with benchmark output

- To receive recommendations on end-to-end processes

- To reduce duplication of efforts

- To optimise and improve the performance and efficiency of the models

The validation process involves testing the cashflows by constructing, for example, an Excel spreadsheet for all the products modelled based on documented assumptions. Then, the output of the Excel model is compared to the Prophet model output for a sample of policies and any potential discrepancies in modelling are investigated and documented. Other kinds of validations include back-testing or dynamic validation.

To ensure processes are properly executed and procedures are followed, the appropriate application of model signoffs may also be tested.

Model validation forms part of the Model Governance framework which is discussed below.

Model Governance

A robust framework for model governance is essential to enforce enterprise standards. This includes:

- Documenting coding best practices and standards (e.g., inclusion of code descriptions and objectives, use of input parameters)

- Documentation of model changes including objectives and descriptions of changes along with impact analysis

- Maintenance of testing and production environments

- Incorporating and maintaining a change log including any updates for each version release

- Segregating the model owner and developer while stating clear duties and responsibilities

- Model version control for each release

- Rules around access control

Adherence to model governance policies and standards is vital for insurance companies to ensure a smooth and reliable operation of the processes.

Conclusion

FIS ® Insurance risk suite (formerly, Prophet) offers a comprehensive solution for insurance firms enabling them to carry out actuarial modelling tasks - whether simple or complex - seamlessly. Prophet model developers use applications like DCS for data formatting and features like the diagram view and schedule to understand inter-connection between products and variables in a Prophet workspace.

Advanced features like the ALS library can help measure the impacts of various investment strategies. The use of extended formula and stochastic modelling enables firms to perform complex calculations, simulations, or scenario analyses and to better understand their results to make informed decisions.

Also, with the growing regulatory focus on model accuracy and governance, insurers may need to consider consolidating their models and enable a seamless production environment, especially when facing resource constraints. Firms may consider migrating their actuarial models involving Prophet for a range of benefits - their validation becomes an essential aspect for sound model governance and audit trail.

How can Finalyse help?

Finalyse has a dedicated team of actuaries and risk modellers who can provide advice and support for all of your modelling needs involving Prophet and beyond, including:

- Development: we review, enhance, develop, or test models for both reserving and pricing purposes using best practices

- Controls and Processes: we review or help improve the current control environment, governance, change control and documentation

- Identify and resolve pain points: we help identify pain points or modelling challenges and resolve these to improve efficiency

References

[1] FIS is short term for Fidelity National Information Services, Inc. based out of Florida, USA

[2] FIS ® Insurance risk suite was formerly known as Prophet which is owned by FIS. Many actuaries use the terms ‘Prophet model’, ‘Prophet Professional’ or ‘Prophet workspace’ inter-changeably, we also refer to Prophet through-out this post.

[3] An accumulation in Prophet workspace allows the aggregation of results from one or more products or accumulations. It can be used to generate the input necessary for the calculation at a higher level of aggregation.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support